Long Term Care Insurance- Why You Need It- CT and NY

Long Term Care Insurance is one of those products which nobody really understands. When I listen to insurance agents explain it, I just hear gibberish. But it is a very important one of a kind product that can preserve your assets.

Long Term Care Insurance is a Tough Sell

Legal Sweeney has had previous experience with selling Long Term Insurance because he previously worked for an insurance agency. Long Term Insurance can be a tough sell. Pay $3K of premiums for 25 years in the oft chance you need it. People couldn’t wrap their heads around it and couldn’t write that check in order to secure the benefits the Long Term Insurance can provide.

Children Buy It Because they Know

Long Term Care Insurance CT and NY

Long Term Care Insurance in Connecticut and New York

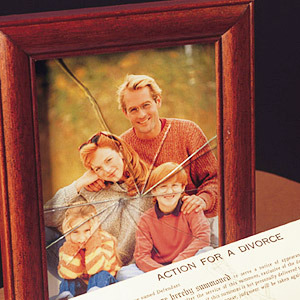

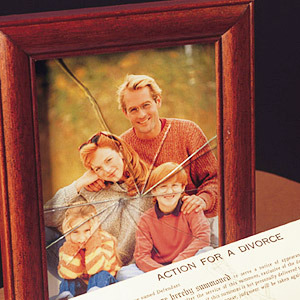

Do you know who were the ones who came in and bought Long Term Care Insurance without us needing to sell it? The children of parents who needed it and didn’t have it. They had just had their parents go into nursing homes and eat up their savings at the rate of $10K per month.

When they were finally out of money they were impoverished and went onto Medicaid. They left nothing to the kids. The financial devastation and power of these experiences caused the children to swear they would never let it happen to them. So, they bought Long Term Care Insurance for themselves to make sure their children didn’t have to go through the same thing.

How to Pay for Nursing Home Care

If you need assisted care or a nursing home, you have to pay for it yourself, until you are out of money and then the government will pick up the tab (Medicaid). So, 3 years at $10K a month is $360K of assets, wiped out. Five years is $600K.

There is nothing you can do to avoid this except:

- Save more money so you don’t run out

- Eliminate your assets and income to qualify for Medicaid (you need to be 5 years ahead of the curve)

- Buy Long Term Care Insurance.

How Long Term Care Insurance Works

Long Term Care Insurance is a simple product. You pay premiums for life until you become disabled, then the insurance company will give you a certain amount of money each day to pay for your care. Normally, the number of days they will pay is capped.

For example, if you are 55 and good health, your life expectancy is about 25 years. So if you pay $3K per year in premiums that is $75K in premiums. If you are disabled for 3 years with a $300 a day benefit, the insurance company has paid out $330K in benefits.

A good deal? Generally if it works out this way, long term care insurance can be a good deal. If you pass away without using the benefit, it is not. Kind of like fire insurance on your house, but hey, who wants to use their fire insurance.

Buy it Around 55 and in Good Health

If you are going to buy Long Term Care Insurance, you want to buy it when you are in good health since the insurance company is going to evaluate your health and price the policy accordingly. If you have big health problems, you won’t get it. The rule of thumb is that 55 and in good health is the best time to buy long term care insurance.

You Don’t Need Long Term Care Insurance if you are Rich-But it is Nice to Have

Most well off people don’t by Long Term Care Insurance because they can self-fund their care. For instance, if you have $2M in the bank at 6% it yields $120K per year in earnings. Your care is $110K per year. So you can pay for care, and not diminish your assets. You can still buy it as a planning tool to preserve your assets for your kids. Generally, $1M in assets and less and you should be looking at Long Term Care Insurance.

Connecticut and New York have some unique laws around Long Term Care Insurance so it makes a difference if you live in Newtown CT or Lewisboro NY.

The majority of seniors want to stay in their homes as long as possible. In-home elder nursing care allows them to do it. Plus, it’s less expensive than institutional care–such as what’s provided at assisted living facilities and nursing homes. This type of care can include medically-related home health care and non-medical care including assistance with activities of daily living and domestic chores.

Below, you’ll find helpful advice and information on how to pay for long term care is assisted living facilities through Medicaid, Medicare, and other federal, state and local programs.

Long Term Home Health Care for the Elderly is a Popular Option

These days, the market for home nursing care is exploding thanks to the baby boomers reaching their golden years and requiring lower-priced alternatives to institutional facilities when considering long term care options. A viable solution when caring for seniors in their home, where they can remain surrounded by their family, friends, and belongings, is to hire an in-home elder care nurse for long term care services.

In-home nurses help out with a variety of medically-related tasks including:

- Administering medications and intravenous injections

- Providing wound and traumatic injury care

- Managing chronic and life-threatening illnesses or disorders

- Providing care for wounds and traumatic injuries

- Monitoring an elderly patient’s medical status keeping detailed records for healthcare providers

- Providing alerts, updates, and feedback to family, other caregivers, and primary physicians

- Maintaining tube feedings

- Tracheotomy, colostomy, and ventilator care

- Hospice and palliative care

Many Seniors May Be Eligible for Home Care Benefits for Long Term Care

Many who opt for in-home nursing care are concerned about the costs. But, many aging adults may be eligible for home health care benefits. Home nursing care for seniors in need of long term care may be wholly or partially paid for through:

- Private Health Insurance

- Supplemental Long-Term Care Insurance Policies

- Medicare or Medicaid

- Veterans Assistance

- Managed Care Organizations

- State and Federal Funding Assistance

- Supplemental Social Security Income for Long-Term Illnesses

- State and Federal Funding Assistance

Home Care Assistance for Veterans

Veterans who are eligible for a VA pension may be entitled to what is called Housebound benefit. This is a payment made to veterans who are receiving care in their own homes or in the home of a family member and are in need of long term care.

Veterans may be eligible for the Housebound benefit if they meet specific criteria. For more information, or to apply for the Housebound benefit, veterans should call their regional VA office or apply online using the VA’s VONAPP (Veterans OnLine Application) website.

Home Nursing Care May Be Your Best Option for Long Term Care

Inviting home health caregivers into your or your loved one’s home and life is a big decision for everyone involved. All aging adults have their own unique set of needs. It will require everyone working together to develop and deliver a personalized care plan based on the patient’s short and long-term care goals.

Fortunately, in-home elder care nursing can be customized to meet your family and loved one’s needs, with caregivers often able to work as needed–on rotating shifts, 24 hours a day, and seven days per week. To find out more about how you or your loved one can benefit from long term care, and to ensure your rights are protected, contact Legal Sweeney today.